Mortgage default rate rises to high not seen since fall of 2020

Mortgage default rate rises to high not seen since fall of 2020

The default rate for first mortgages rose to a high not seen in nearly two years during June, according to indices published by Standard & Poor’s and Experian.

The first-lien mortgage default rate during the month was 0.38% or 38 basis points, compared to 0.36% in May and 0.26% a year earlier. The default rate in that category hasn’t been that high since September 2020, when it was 0.46%.

The slight increase suggests the ongoing rollback of forbearance has helped normalize the loan performance indicator, but it hasn’t returned to pre-pandemic levels yet. The mortgage default rate had been at the higher end of a range between 0.59% and 0.84% in the period prior to March 2020, and got as high as 2% in the wake of the Great Recession during the 2000s.

While the first-mortgage default rate remains historically low, the recent increase adds to signals suggesting that borrowers exiting pandemic-related forbearance into a market with higher rates and inflation are feeling more strain when it comes to their ability to repay..

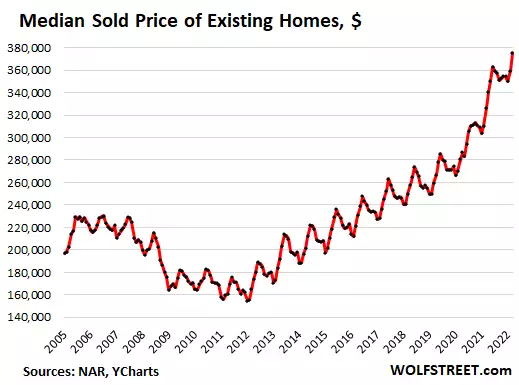

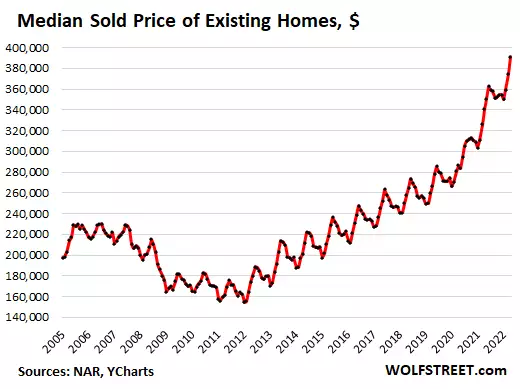

High home equity levels have insulated many people from the small uptick in default risk, but if rising consumer costs start to affect the economy, it could become more of a concern, Federal Housing Finance Agency Director Sandra Thompson said Wednesday.

“If economic conditions deteriorate, there will likely be negative implications for homeowners,” Thompson said in testimony before the House Committee on Financial Services, noting that post-forbearance relief like modifications of loan terms for affordability purposes remain available.

So far the composite default rate that serves as a broader indicator of consumer distress has followed a similar path as the mortgage indicator, rising 2 basis points to 0.53% in June. The auto loan default rate rose by only a basis point from May to 0.62%.

However, June’s jump in the default rates for second mortgages and bank cards was more pronounced. Both increased 6 basis points compared to May, suggesting an uptick in short-term consumer distress during the month. The default rate for home equity loans and lines of credit in June was 0.45%. The default rate for bank cards was 2.55%. Consumers are often quicker to default on bank cards or loan products secured by second liens than first mortgages.

In addition to modifications, money available from the Homeowner Assistance Fund has been limiting default risk. The fund contains more than $9.96 billion that the majority of states have available to distribute to distressed homeowners for mortgages and other housing needs. A couple of states, like Illinois and Alaska, have closed their programs, but most remain active, according to the National Council of State Housing Agencies.

“Servicers have told me how useful the homeowner assistance fund has been and that’s pretty much been rolled out in all the states now,” Richard Koch, structured finance director at Fitch, said in an interview. “Although I’m not fond of this phrase, I think it has kind of helped prevent the ‘foreclosure tsunami’ everyone was worried about.”