Have You Heard The One About The Sideways, Volatile Range?

Have You Heard The One About The Sideways, Volatile Range?

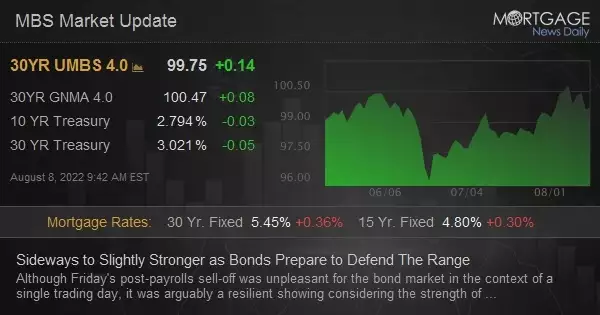

It's been the phrase we love to hate since late May when bond yields encountered firm resistance as they failed to break below 2.7% for 4 straight days. At the time, we couldn't see a case for much more of a rally as that would require several months of tamer inflation data. June's bounce was no surprise in that context, but last week's hotter CPI data made the bounce bigger than it otherwise might have been.

We're still in a volatile sideways range, with a strong enough suggestion for a ceiling from a big double bounce at 3.50% on Tuesday and Thursday. 3.31 has been a good pivot point over the past 2 days, most recently helping stem the tide of early weakness in today's trading session.

In the slightly bigger picture, we'd add 3.28 to 3.31 to create a bit of a pivot zone overhead as 3.28 was a bit more relevant before these past 2 days.

The chart above shows the broader sideways range in hourly candlesticks. Here's how it looks with daily candles and a slightly wider frame of reference.

In this context, breaking below 3.15 would be define victory for bond bulls. Avoiding a break of the 3.5 ceiling would keep bond bulls in the game. In any event, we don't expect to get solid cues from trading until next Wednesday due to Monday's holiday closure and the likelihood that Tuesday will see lighter-than-normal participation/liquidity.