Episode 87 - Paul Grimme bought a FRACTURED condo. Yikes!

Episode 87 - Paul Grimme bought a FRACTURED condo. Yikes!

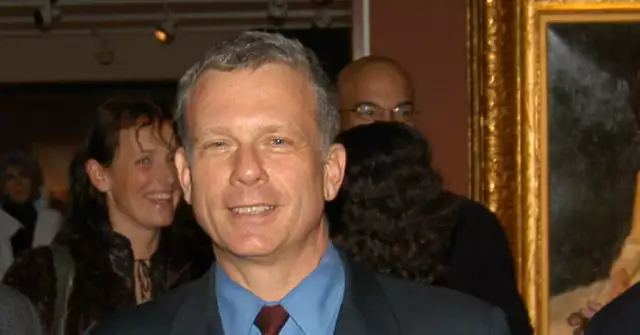

Paul Grimme is originally from Nebraska. After 28 years in the hi-tech industry he retired in 2016. Paul explains what lead him to investing and buying apartments. Paul had not gone the typical route of investing in single family homes but he did passively invested in five multifamily partnership opportunities with over 1000 doors. On his first large real estate transaction, Paul bought a fractured condo. Paul and his wife, Julie, bought 76 out of 108 units in the Village Condominiums in Waco, Texas. He bought 70% of the total. One seller was selling a block of units that they owned. The remaining 32 units were owned by individuals and were not available for sale. A fractured condo can be an unusual investment. Unlike apartments, where you buy ALL the units at one time; a fractured condo acquisition is when you are buying a specific number of units in a condominium complex. Investing in a fractured condo comes with some unique challenges like “who controls the management of the homeowners association and where and how those dues going to be spent?” Paul reflects on the history of the condominiums and how it became a fractured condo. The investment strategy, over a period of time, is to purchase all the remaining condo units, crush the condo association and then operate the property like an apartment property. Here is Paul’s contact info: paul@cherokeecreekinvestments.com To receive our FREE 15 page WHITE PAPER REPORT on the 2017 FUNDAMENTALS OF MULTIFAMILY FINANCING 101 and to learn more about upcoming events at Old Capital Speaker Series please visit us at OldCapitalPodcast.com Are you interested in learning more about how Multifamily Syndications work? Please visit www.spiadvisory.com to learn about Michael's Real Estate Syndication business with SPI Advisory LLC.