Plunging mortgage rates held off a Seattle home price crash

Plunging mortgage rates held off a Seattle home price crash

The article provides an analysis of the affordability index for various counties in the Puget Sound area in August 2020. The affordability index is a measure that compares the monthly costs of a median-priced home to the median household income in the area. An index level above 100 indicates that the monthly payment on a median-priced home costs less than 30% of the median household income, while an index below 100 means that the monthly payment is over 30% of the median income.

According to the data presented in the article, the affordability index for the Puget Sound area in August 2020 is 95.1, which is somewhat lower than the historical average of 107.6 from 1993 to 2002. The article also notes that 69 percent of the 331 months on record back through 1993 have had a higher affordability index than what was recorded in August 2020. However, the article also points out that if interest rates were at a more historically sane level of 6 percent, the affordability index would be 66.4, which is worse than every other month on record except July 2007, the absolute peak of the previous housing bubble.

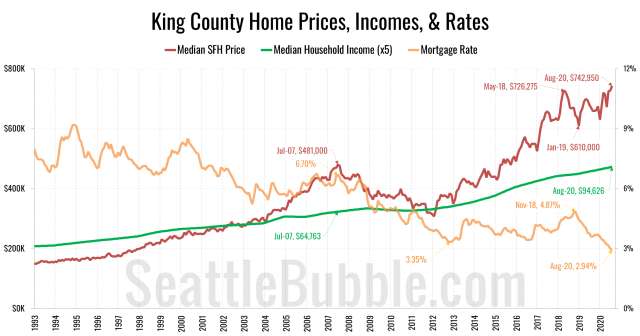

To further understand the changes in the affordability index, the article breaks it down into its individual components: home prices, incomes, and interest rates. The article states that in 2017 and early 2018, home prices in the area rapidly increased, causing a significant decrease in the affordability index. However, by January 2019, home prices had fallen by 16 percent. The article suggests that the sudden drop in mortgage rates in 2018, which fell from 4.87% in November 2018 to 2.94% in August, may have helped slow down the decline in home prices and improve the affordability index.

The article also provides charts and data for the affordability index in King County, Snohomish County, Pierce County and outer Puget Sound counties. In King County, the affordability index currently sits at 95.1. Snohomish County and Pierce County have also seen similar improvements in affordability, driven almost entirely by declining mortgage rates. The affordability index in Snohomish County currently sits at 120.8, while Pierce County is at 125.0. Both are at levels comparable to 2008 or 2009. The article also provides a bonus chart for the affordability index in the outlying Puget Sound counties.

Lastly, the article provides a formula and calculator to determine whether a home purchase is affordable based on the affordability index measure. The formula for the affordability index is based on three factors: median single-family home price, 30-year monthly mortgage rates, and estimated median household income. The historic standard for "affordable" housing is that monthly costs do not exceed 30% of one's income.

Let's say the median single-family home price in a certain county is $500,000, the 30-year monthly mortgage rate is 3% and the estimated median household income is $75,000. Using the affordability index formula:

Affordability Index = ($500,000 x 3.0%) / ($75,000 / 12)

The monthly mortgage payment on the median-priced home would be $1,250, which is 30% of the median household income of $75,000. Therefore, the affordability index for this scenario would be 100.

According to the standard, this home purchase would be considered affordable because the monthly costs do not exceed 30% of the median household income. However, if the interest rate was higher, for example 4% the calculation would be: Affordability Index = ($500,000 x 4.0%) / ($75,000 / 12)

The monthly mortgage payment on the median-priced home would be $1,666, which is around 22% of the median household income of $75,000. Therefore, the affordability index for this scenario would be around 133.

It's worth noting that this is a simplified example and that there are many other factors that can affect the affordability of a home purchase, such as down payment, closing costs, and property taxes. Additionally, this example doesn't take into account the historical average of the area or the other factors that can affect the affordability index.