Multifamily vs. Single Family Homes: Which is Right for You as an Investment Vehicle?

Multifamily vs. Single Family Homes: Which is Right for You as an Investment Vehicle?

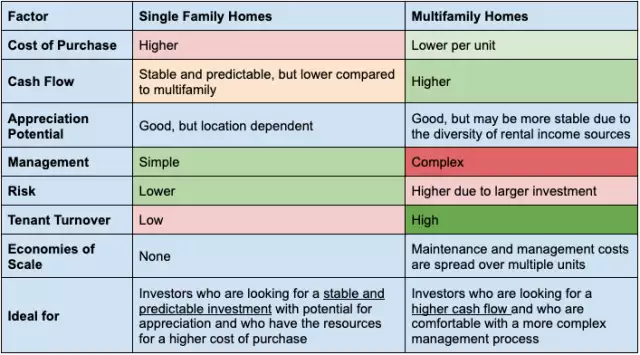

When it comes to real estate investing, there are two main options for residential properties: multifamily homes and single family homes. Both have their own unique benefits and drawbacks, and the right choice for you will depend on your investment goals and personal preferences.

Single Family Homes

Single family homes are standalone structures that house only one family. These properties can range from small cottages to sprawling estates, and they are often the preferred choice for families looking to purchase a primary residence.

Benefits of single family homes as an investment vehicle:

- Stable and predictable cash flow: Renting out a single family home can provide a stable and predictable cash flow, as tenants are usually families or long-term renters.

- Appreciation: Single family homes tend to appreciate in value over time, which can lead to significant gains for the investor.

- Simplicity: Single family homes are often simpler to manage and maintain than multifamily properties, making them an attractive option for novice real estate investors.

Drawbacks of single family homes as an investment vehicle:

- High cost: The cost of purchasing a single family home can be significantly higher than a multifamily property, making it a less accessible option for some investors.

- Lower cash flow: Single family homes often generate lower rental income compared to multifamily properties, which can make it more difficult to achieve positive cash flow.

- Location-dependent: The rental income and appreciation of a single family home are largely dependent on the location, meaning that an investment in a low-income area may not generate the same returns as one in a high-income area.

Multifamily Homes

Multifamily homes, also known as apartment buildings, are properties that contain multiple dwelling units within the same structure. They can range from small duplexes to large apartment complexes and can provide a higher return on investment compared to single family homes.

Benefits of multifamily homes as an investment vehicle:

- Higher cash flow: Multifamily properties tend to generate higher rental income compared to single family homes, making them an attractive option for investors seeking a higher return on their investment.

- Lower cost per unit: The cost of purchasing a multifamily property is often lower per unit compared to single family homes, making it a more accessible option for some investors.

- Economies of scale: Multifamily properties often benefit from economies of scale, as the costs of maintenance and management can be spread out over multiple units.

Drawbacks of multifamily homes as an investment vehicle:

- Complexity: Multifamily properties can be more complex to manage and maintain compared to single family homes, which may be a challenge for novice real estate investors.

- Tenant turnover: Multifamily properties often have a higher rate of tenant turnover compared to single family homes, which can lead to higher costs and more time spent finding new tenants.

- Risk: Multifamily properties often require a larger investment compared to single family homes, which can make them riskier for some investors.

Frequently Asked Questions:

Q: What are single family homes?

A: Single family homes are standalone structures that house only one family. They can range in size and can be used as a primary residence or as an investment property.

Q: What are the benefits of single family homes as an investment vehicle?

A: The benefits of single family homes as an investment vehicle include stable and predictable cash flow, potential for appreciation, and simplicity of management.

Q: What are the drawbacks of single family homes as an investment vehicle?

A: The drawbacks of single family homes as an investment vehicle include a higher cost of purchase, lower cash flow compared to multifamily properties, and location dependence for rental income and appreciation.

Q: What are multifamily homes?

A: Multifamily homes, also known as apartment buildings, are properties that contain multiple dwelling units within the same structure. They can range from small duplexes to large apartment complexes.

Q: What are the benefits of multifamily homes as an investment vehicle?

A: The benefits of multifamily homes as an investment vehicle include higher cash flow, lower cost per unit compared to single family homes, and economies of scale in terms of maintenance and management.

Q: What are the drawbacks of multifamily homes as an investment vehicle?

A: The drawbacks of multifamily homes as an investment vehicle include complexity of management, higher tenant turnover, and higher risk compared to single family homes due to a larger investment.

Q: Which is better for me, single family homes or multifamily homes?

A: The right choice for you will depend on your investment goals, personal preferences, and level of experience in real estate investing. Before making a decision, it's important to consider all the factors and conduct thorough research and due diligence to ensure that you make the best choice for you.

In conclusion, both single family homes and multifamily properties have their own unique benefits and drawbacks as investment vehicles. The right choice for you will depend on your investment goals, personal preferences, and level of experience in real estate investing. Before making a decision, it's important to consider all the factors and conduct thorough research and due diligence to ensure that you make the best choice for you.